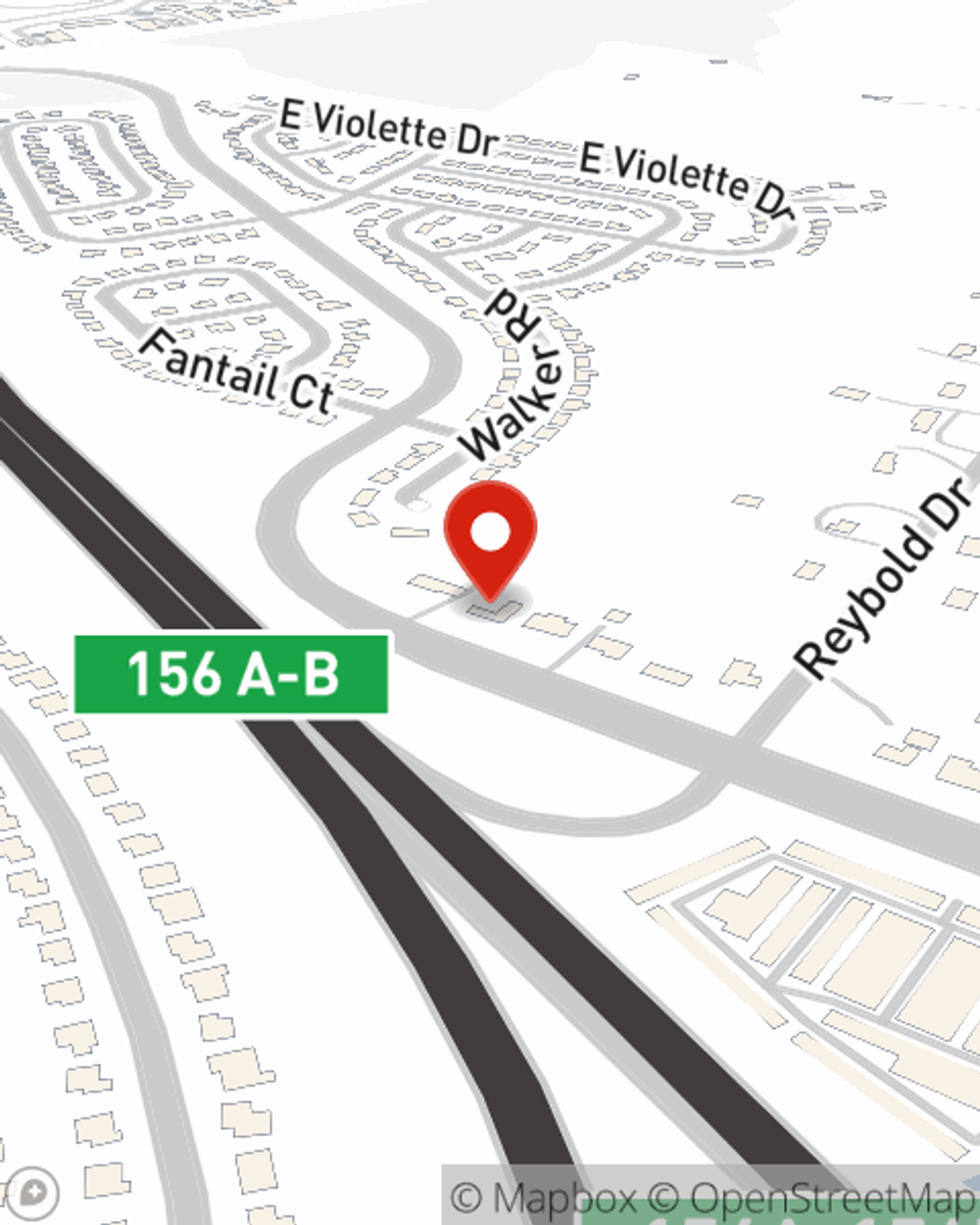

Business Insurance in and around New Castle

One of New Castle’s top choices for small business insurance.

No funny business here

Insure The Business You've Built.

As a small business owner, you understand that running a business can be risky. Unfortunately, sometimes mishaps like a customer stumbling and falling can happen on your business's property.

One of New Castle’s top choices for small business insurance.

No funny business here

Protect Your Business With State Farm

No one knows what tomorrow will bring—especially in the business world. Since even your brightest plans can't predict natural disasters or product availability. In business, you can be certain of one thing: nothing is certain. That’s why it makes good sense to plan for uncertainty with a State Farm small business policy. Business insurance covers your business from all kinds of mishaps and troubles.. It protects your future with coverage like business continuity plans and errors and omissions liability. Terrific coverage like this is why New Castle business owners choose State Farm insurance. State Farm agent Dimple Abraham-Myers can help design a policy for the level of coverage you have in mind. If troubles find you, Dimple Abraham-Myers can be there to help you file your claim and help your business life go right again.

Take the next step of preparation and visit State Farm agent Dimple Abraham-Myers's team. They're happy to help you learn more about the options that may be right for you and your small business!

Simple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

Dimple Abraham-Myers

State Farm® Insurance AgentSimple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.